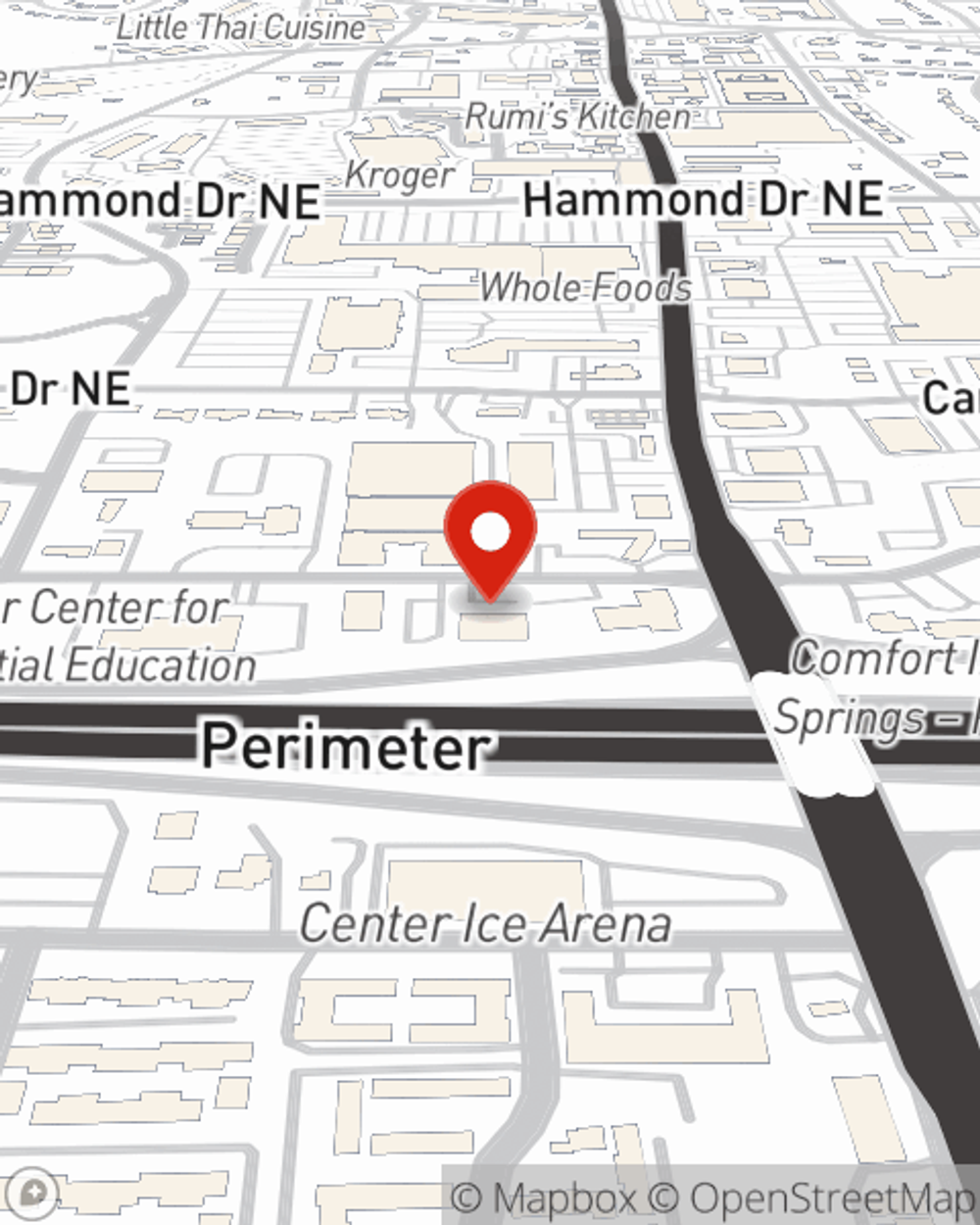

Homeowners Insurance in and around Atlanta

Atlanta, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Atlanta

- Metro Atlanta

- Sandy Springs

- Marietta

- Roswell

- Smyrna

- Fulton County

- Cobb County

- Dekalb County

- Gwinnett County

- Cherokee County

- Forsyth County

- Bartow County

Home Sweet Home Starts With State Farm

You want your home to be a place to recharge after a stressful day at work. That doesn't happen when you're worrying about your kids coloring on the walls again, and especially if you don't have homeowners insurance. That's why you need us at State Farm, so all you have to worry about is the first part.

Atlanta, make sure your house has a strong foundation with coverage from State Farm.

The key to great homeowners insurance.

Agent Stephen Cole, At Your Service

Stephen Cole will help you feel right at home by getting you set up with secure insurance that fits your needs. Protection for your home from State Farm not only covers the structure of your home, but can also protect prized possessions like your grandfather clock.

Don’t let fears about your home make you unsettled! Contact State Farm Agent Stephen Cole today and see the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Stephen at (404) 856-3850 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How much to budget for home maintenance

How much to budget for home maintenance

Understanding the lifespan of a house and how much to budget for home maintenance can help you be more prepared when it’s time for those costly repairs.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.

Stephen Cole

State Farm® Insurance AgentSimple Insights®

How much to budget for home maintenance

How much to budget for home maintenance

Understanding the lifespan of a house and how much to budget for home maintenance can help you be more prepared when it’s time for those costly repairs.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.